Meet Charlottesville’s Top-Rated Mortgage Brokers

Charlottesville, Virginia, is renowned for its rich history, vibrant arts scene, and stunning landscapes. Whether you’re a lifelong resident or a newcomer, navigating the local real estate market can be daunting—especially when it comes to securing a mortgage. This is where the expertise of top-rated mortgage brokers shines. Today, we’re excited to introduce you to some of the most trusted mortgage experts in the area, with a special focus on Joe Reed, whose impressive background and local insight set him apart.

Who is Joe Reed?

A Local Legend with a Solid Foundation

Meet Joe Reed—not only a well-respected mortgage broker at Alcova Mortgage but also a former standout football player at the University of Virginia (UVA) and a professional athlete in the NFL with the Los Angeles Chargers. His journey from the football field to the finance field is marked by dedication, discipline, and an unwavering commitment to helping others.

Living in Crozet, VA, Joe is deeply connected to the Charlottesville community. With a strong understanding of local real estate trends and an extensive network of industry contacts, Joe is poised to guide first-time homebuyers, those looking to refinance, and savvy real estate investors toward their financial goals.

Bridging the Gap Between Dreams and Reality

With a passion for assisting clients through one of the most significant financial decisions they will ever make, Joe Reed combines his background in athletics with a commitment to service. He applies the same teamwork approach that brought him success on the field to every client’s mortgage experience. At Joe’s core is the belief that no two clients are the same, and he approaches each loan application with personalized strategies designed for your unique situation.

Why Choose a Top-Rated Mortgage Broker?

Choosing the right mortgage broker is critical to securing the ideal home loan. But what exactly makes a mortgage broker “top-rated”? Here are some key reasons why working with a respected broker like Joe Reed is essential:

Expertise and Knowledge

- Market Insight: Top-rated brokers have extensive knowledge of the local housing market—including neighborhoods, price trends, and housing types—allowing them to provide tailored advice.

- Loan Options: They can offer a variety of loan products tailored to fit different financial situations, ensuring clients find the best fit for their needs.

- Problem Solving: Experienced brokers help navigate potential roadblocks during the loan process, minimizing stress for clients.

Personalized Approach

- Understanding Your Needs: A quality broker listens to your goals and constraints, allowing them to propose solutions that resonate with your financial picture.

- Building Relationships: Top-rated brokers prioritize building trust and maintaining relationships, giving clients peace of mind during the home-buying journey.

Access to Resources

- Network of Professionals: Established brokers often have strong connections with real estate agents, lenders, and appraisers, providing integrated support throughout the home-buying process.

- Current Trends: Well-informed brokers stay updated on market trends, allowing clients to take advantage of favorable conditions.

Make the right choice—consider working with a top-rated mortgage broker like Joe Reed, whose local knowledge and dedication to excellent service can help you realize your dream of homeownership.

Understanding the Charlottesville Housing Market

Local Neighborhoods to Consider

Charlottesville is home to diverse neighborhoods, each with its own charm and character:

- Downtown Charlottesville: Known for its historic architecture, vibrant shops, and restaurants, this area is popular among young professionals and those seeking a lively atmosphere.

- Westslope: Nestled against the mountains, this peaceful neighborhood offers great views and a family-friendly environment. It has access to excellent schools and parks, making it an ideal location for families.

- Pantops: Just minutes from downtown, Pantops features stunning views, convenient shopping, and easy access to hiking trails in the nearby Blue Ridge Mountains.

Housing Market Trends

Understanding the local housing market is key to making informed decisions:

- Growing Demand: As more people move to the area, housing demand continues to increase, affecting inventory levels and prices. This underscores the importance of working with a knowledgeable mortgage broker who is aware of the shifts in the market.

- Interest Rates: It’s essential to keep an eye on interest rates, which can fluctuate based on economic conditions. A top-rated mortgage broker like Joe Reed will help you lock in favorable rates to save you money over the duration of your mortgage.

Practical Tips for First-Time Homebuyers

Getting Pre-Approved

Get pre-approved for your mortgage before house hunting. This step not only gives you a clear picture of your budget but also shows sellers that you are a serious contender. Joe Reed can guide you through obtaining a pre-approval quickly and efficiently.

Save for a Down Payment

Saving for a down payment can seem daunting, but there are various options available:

- Traditional 20% Down: This option avoids PMI (Private Mortgage Insurance) but requires significant savings.

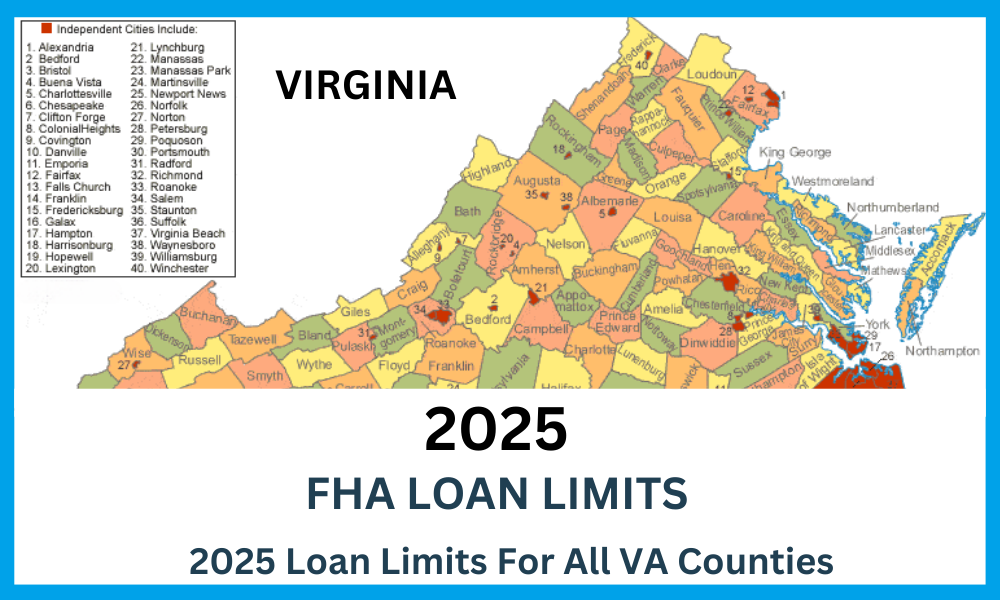

- FHA Loans: If you’re a first-time homebuyer, consider an FHA loan, which allows for low down payments (as low as 3.5%).

- Assistance Programs: Explore local programs that assist with down payment assistance, making homeownership more accessible.

Understand Your Loan Options

Different mortgage products cater to different needs:

- Fixed-Rate Mortgages: Ideal for buyers who prefer stable monthly payments throughout the loan term.

- Adjustable-Rate Mortgages (ARMs): These loans may start with lower rates, adjusting over time, which could be beneficial in certain financial situations.

- VA Loans: If you’re a veteran or active military member, you may qualify for VA loans with favorable terms.

Work with Joe Reed for Tailored Advice

Navigating the mortgage process can be daunting, but with Joe Reed by your side, you’ll have access to personalized advice tailored to your situation. His familiarity with the local market and mortgage products ensures that you’re in the best hands possible.

FAQs About Mortgages

What Should I Look for in a Mortgage Broker?

Seek brokers with:

– Local expertise and knowledge.

– Positive client reviews and testimonials.

– A proven track record of success.

How Do I Qualify for a Mortgage?

Qualifying typically involves:

– A steady income.

– A reasonable credit score (generally 620 or higher).

– A manageable debt-to-income ratio.

What Are Closing Costs?

Closing costs typically range from 2% to 5% of the loan amount and include fees for services such as:

– Appraisal fees.

– Title insurance.

– Loan origination fees.

How to Contact Joe Reed

Looking for personalized mortgage solutions? Now that you’ve gathered insights about securing a mortgage in Charlottesville, reach out to Joe Reed at Alcova Mortgage. His expertise and commitment to your goals can help you navigate the complexities of financing your dream home.

Contact Joe Reed at Alcova Mortgage for Personalized Home Loan Solutions.

Visit Joe Reed’s Professional Page

Conclusion

Navigating the world of mortgages can be a complex journey, but with the help of top-rated mortgage brokers like Joe Reed, you can tackle the process with confidence. From understanding local market trends to accessing a variety of loan options, Joe’s local expertise and personal touch make him a trusted partner for your home loan needs.

Whether you’re a first-time buyer or looking to refinance, Joe Reed’s dedication to personalized service will ensure you receive the guidance and support you need. Don’t hesitate; take the first step towards your dream home today!